The ability to take secure online payments is a vital part of all types of eCommerce businesses. Security is how you can establish trust among your customers and that security comes from working with a trusted payment processing company like BlueCart and using efficient business systems-even during seasonality in business.

The typical payment processing provider offers certain services and works to ensure that financial information stays secure while a payment goes through. Parties involved in these transactions usually include the customer, the merchant, the payment processor, the payment gateway providers, the customer’s bank (see best banks for eCommerce business), and the merchant’s bank. Considering the information travels through so many entities, it’s important that your payment processor has the tools to protect you and your customer, as well as keeping your business in PCI compliance.

Learn more about some online payment processing companies and which ones may be suitable for you and your business.

Online Payment Processing Companies

Picking a payment processor is something that multiple people should weigh in on, as it doesn’t affect just the finance department. For example, if you pick a payment processing company online that does not offer integrations or customizations with the eCommerce software you use, then you could very likely lose a sale as customers may leave if they’re redirected to another site. That, in turn, affects conversions and eCommerce KPIs for your marketing team. Check out this list of payment gateway providers that you may want to consider:

Stripe

Stripe offers payment processing that is good for both desktop and mobile settings. You can have your developer create a customized checkout experience, or opt to use theirs. Either way, it will provide your customer with a secure checkout process and links to your merchant account so that you can get your payment. Transaction fees for Stripe are 2.9% + $0.30, or you can speak with them about a custom package if you conduct a large number of online transactions. Stripe also gives you access to updates as they come out. If you're making the transition from offline to online (o2o), you may already be using Stripe. If you decide to work with BlueCart for your business, you’ll get all of the features Stripe provides, including a secure payment gateway and more. You will also be featured in our online marketplace and get access to over 92,000 buyers. You can process transactions in the form of ACH payment, eCheck payment, and more. You can even set up recurring payments within the app.

PayPal

Since its debut in the late 90s, PayPal has become a trusted online transaction facilitator for hundreds of millions of people--392 million, to be exact. It’s a popular choice because there are no contract or termination fees and they also do not slap businesses with any hidden fees. Each transaction has the standard 2.9% + $0.30 fee. PayPal also offers buyers other options like PayPal Credit where they can choose to make four payments over time. It comes with a payment gateway as well, so you can take payments easily, even if you operate on a net 30 payment model.

Square

Many businesses choose Square because of the payment tools they provide. Their contactless chip reader and stand allow for any mobile device to process payments, and they handle online payments as well. It’s often the choice of smaller businesses that have both a physical location and a digital storefront, as all of their payments will be stored in one convenient area and are deposited generally the next business day.

Amazon Pay

One perk of Amazon Pay is that customers can log in using their Amazon credentials and pay without having to enter in any billing information. This convenient method may benefit you, especially if you’re encountering issues with abandoned shopping carts or customers complaining about a long checkout process. The transaction fees may also be lower, depending on the option you choose. Fees can be as low as 1.9% + $0.30.

Braintree

Braintree allows you to accept payments online in just about any format, including Venmo, Apple Pay, Google Pay, and more. Since so many people use their phones to access websites, Braintree may be a good idea if your target market is one that uses mobile more than desktop. It’s powered by PayPal, so it comes with the security and brand reputation of PayPal. You can choose their standard checkout experience or customize it to your brand.

BitPay

Some customers may want to pay for your services using Bitcoin, and that requires a payment gateway that has the capability to turn cryptocurrency into dollars. BitPay can do that, but you will need a digital wallet to accept payment this way. BitPay uses Full Payment Protocol to verify and keep these types of payments secure.

Largest Payment Processing Companies in the US

Most payment processing companies operate in more than one country in order to facilitate easy online eCommerce transactions. But many of them started in the United States, and most of them have been in business for a long time. Some of the largest payment processing companies in the US include:

- First Data (now Fiserv)

- Bank of America

- Wells Fargo

- Elavon

- Chase Bank

While these are all older names, the younger processors are starting to take over some of the market share. For example, companies like Stripe and Square are growing rapidly, and may be better suited for small to mid-size businesses as they provide more innovative products and have found other ways to differentiate themselves from the larger companies. Plus, the larger companies tend to put their focus on their bigger clients, which means they may not offer something that your smaller business needs to successfully manage a transaction.

Did You Process That?

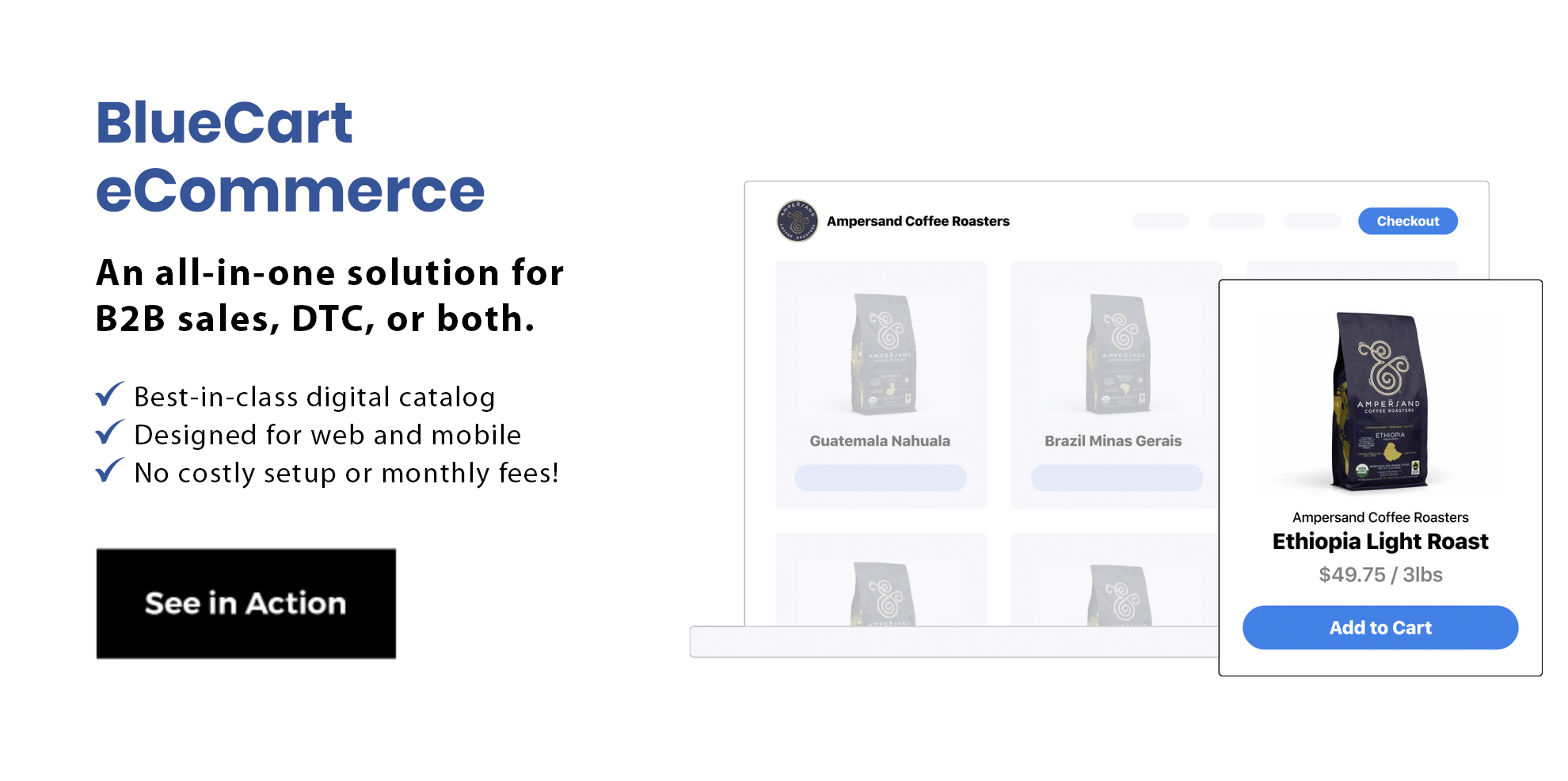

At BlueCart, we help clients with their online transactions every day. We know it can be overwhelming to try and find a payment processing company that provides every single feature you need.

Instead of searching through countless articles online and trying to compare and contrast features of the best payment gateway, reach out to us and schedule a demo. Not only does BlueCart offer payment processing services, we also provide you with a storefront to sell your products and more.