A payment gateway is used to conduct secure online eCommerce payments and keeps credit card information safely encrypted while it determines whether or not the transaction could potentially be fraudulent. If your business uses online payments, then you need a payment gateway to keep both you and your customer protected. Payment gateways are provided by certain companies, and if you don’t have one yet, then you need to find one that is reliable.

Researching payment gateways can be overwhelming and looking into the providers themselves can add a new layer of stress. Each payment gateway provider is slightly different and offers solutions based on their target clients.

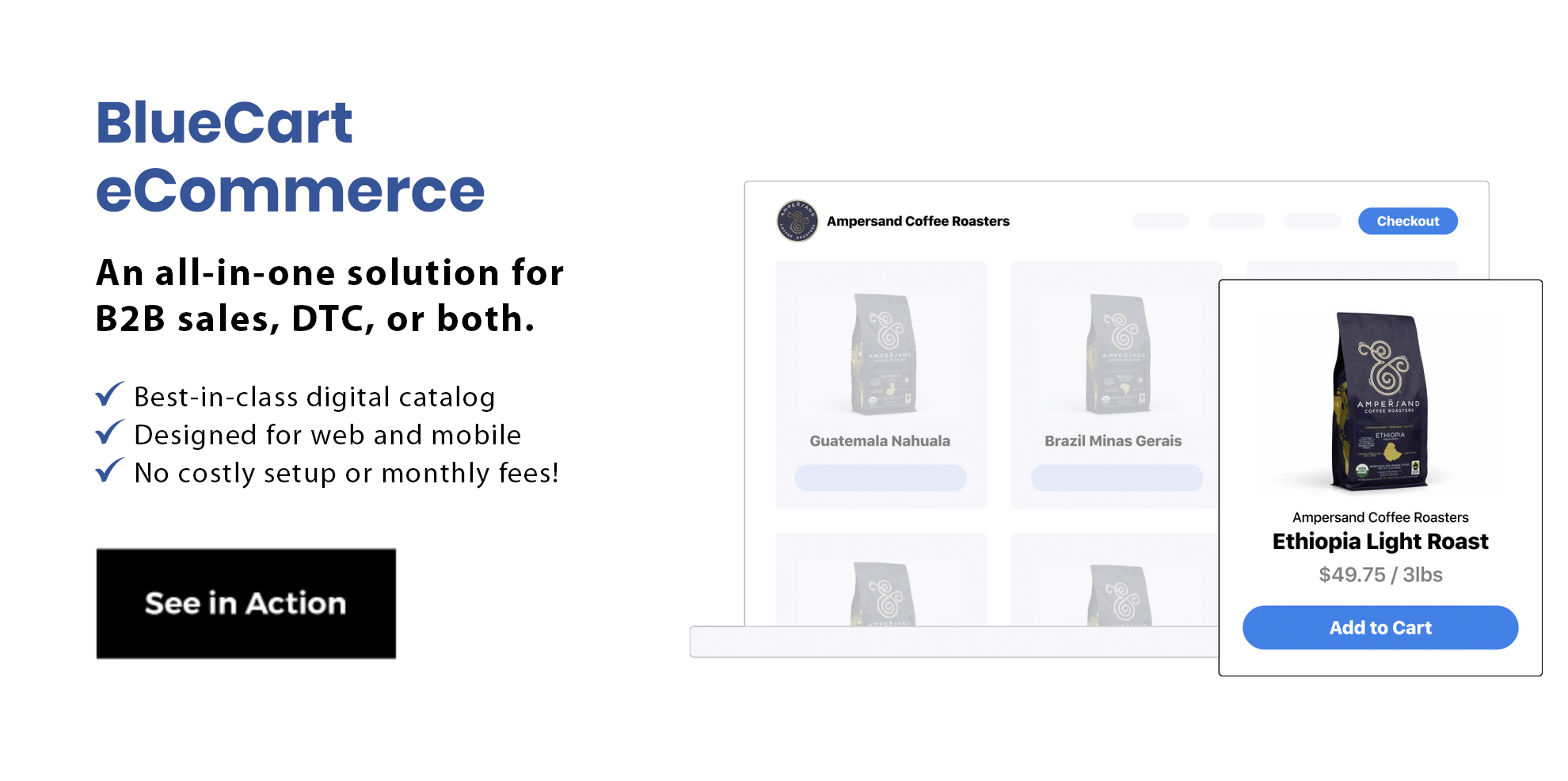

For eCommerce businesses, BlueCart is the best payment gateway provider. It’s an online storefront, payment gateway, subscription billing platform, and more. We have some of the industry’s lowest fees and bank-level security all integrated into a wholesale, ecommerce, and subscriptions platform. You can even set your invoices to net 30 terms or allow prepayment right in the platform.

Payment Gateways In USA

There are many different payment gateways used in the United States. Depending on what types of eCommerce businesses you have, as well as how many online transactions you conduct, there might be one that best fits your organizational needs. Let's learn some more about some of the top payment gateways in the USA.

Stripe Payment Gateway

With Stripe’s payment gateway, you automatically get 100+ features as soon as you sign up. Their pricing is based per transaction as well, with a 2.9% charge + $0.30 for every card transaction. You’ll also get access to the multiple feature updates they make each year, with no hidden fees. For bank debits and transfers, it’s 0.8% or $5 max per transaction. You can also get instant payouts for a 1% fee. Other options you can use include:

- Invoicing

- Connect: Add payments to your platform

- Radar: Use machine learning to help prevent fraud

If you have a larger business, Stripe can design a customized package for you with multi-product discounts, volume discounts, and more. They also offer premium support for more complex businesses, which starts at $1,800 per month. Since BlueCart eCommerce uses Stripe for a payment gateway, you can have access to all of these benefits as a part of your service. Talk about lucky!

PayPal Payment Gateway

Through PayPal, you can get their payment gateway called Payflow. This solution does not have any setup fees or monthly fees, just a fee of $0.10 per transaction. It integrates with many shopping carts and works with most processors. It works for any size business. You can also upgrade to Payflow Pro, which costs $25 a month and allows for unlimited checkout customization. Adding in optional features is also possible, and those include:

- Additional fraud protection services

- Recurring billing

- Buyer authentication

WooCommerce Payment Gateway

Like PayPal, WooCommerce also does not charge any setup or monthly fees. Instead, you pay per transaction, and that fee is 2.9% plus $0.30. There’s also a $15 fee per return and a 1.5% fee for instant payouts from your merchant account. If you want to add in recurring billing, they also offer WooCommerce Subscriptions for an annual fee of $200. With WooCommerce, customers will pay directly on your site instead of on a third-party page, which may help to reduce abandoned shopping carts.

NMI Payment Gateway

NMI payment gateway is typically offered through third parties that partner with NMI, as the company does not market directly to merchants. Fees vary depending on what third party is chosen. For example, one third-party provider charges $10 a month, $0.05 per transaction, and no setup fees. Invoices are $0.05 and if you want to add in ACH payment processing, it’s another $20 a month.

Shopify Payment Gateway

If you opt for Shopify Payments, then you can skip a lot of third-party integrations if you also use Shopify for your store. One convenient feature here is that you can track your orders and payments all in the same spot, which is handy for business owners who are constantly moving. Shopify offers different tiers depending on the size of your business, which are:

- Basic Shopify: This starts at $29 a month and comes with fraud analysis. Online credit card fees are 2.9% plus $0.30 per transaction. You get two staff accounts and shipping discounts of up to 77%.

- Shopify: This tier is suited for a growing business and is $79 a month. Online credit card fees dip slightly to 2.6% and $0.30 per transaction. With this tier, you get up to five staff accounts and shipping discounts of up to 88%.

- Advanced Shopify: For larger businesses, Advanced Shopify offers more features for scalability. This will run $299 a month and gives you up to 15 staff accounts. The same shipping discounts apply but you get more customization as you can see third-party shipping rates.

Authorize.Net Payment Gateway

Authorize.net is a Visa solution, and it costs $25 per month along with a $0.10transaction fee and a $0.10 daily batch fee. You’ll get advanced fraud detection, recurring billing, invoicing, simple checkout, and other features. For an additional fee, you can add on electronic check payments and an account updater. The account updater will keep your customers’ card data up to date, so if their card on file expires, it will update it automatically so you can keep billing them automatically. If you prefer to use a third party, you can also sign up that way and get a merchant account at the same time if you don’t already have one.

BigCommerce Payment Gateway

If you’re using BigCommerce, then they have more than 65 available payment gateways to use. They provide integrations with major eCommerce players and give you the option to choose your preferred gateway that will work with their online store setups. They offer a free trial for 15 days so you can try it to see if it will work for you and your business. Like Shopify, they offer pricing plan tiers for their online payments:

- Standard: $29.95/month

- Plus: $79.95/month

- Pro: $299.95/month

- Enterprise: Custom pricing for businesses that need a full-service open platform

Cybersource Payment Gateway

Cybersource offers fraud protection and a full payment platform that includes a payment gateway. They offer a modular platform so that you can select the payment management solutions that best fit your company. It’s a truly scalable option that can grow with you as your business expands. They ask that you contact them for pricing for their platform.

First Data Payment Gateway

Formerly known as First Data, Fiserv is an electronic payment processing company. They offer solutions for large and small businesses that accept payments online. The company also works with third-party resellers, namely two large ones: Wells Fargo and Bank of America Merchant Services. Fiserv is one of the biggest processors in the world. If you want to use their services, you’ll likely go through First Data Global Leasing. Their products include:

- Carat: Carat is for larger businesses and offers global payment opportunities so that it’s easier to move into new markets around the world.

- Clover: Clover was created for small businesses so that they can accept payments, check inventory, and more all in one spot.

As far as pricing goes, Fiserv typically offers multi-year agreements with early termination fees, and its rates and fees vary by customer.

Braintree Payment Gateway

Braintree is offered by PayPal and is one of the only payment processors that works with Venmo, Google Pay, and Apple Pay payments as well. Braintree offers standard pricing of 2.9% plus $0.30 per transaction, as well as custom pricing that is created based on your business and volume of transactions. They offer both a merchant account and a payment gateway, unlike some companies that only give you a payment gateway. Also included in their offerings are data encryption, support, recurring billing, third-party integrations, and more.

Square Payment Gateway

Square is used by a lot of businesses, as it offers the ability to take both in-person and online payments. They provide payment solutions for any size business, help to decrease fraud, and follow PCI compliance. Customer payment data is encrypted end-to-end so that the card information never enters your devices or servers. For larger businesses, Square offers custom pricing. Their standard pricing varies by type of transaction:

- Card payments are 2.9% plus $0.30

- Card-not-present transactions are 3.5% plus $0.15

- Square virtual terminal transactions are 3.5% plus $0.15

- eCommerce transactions vis Square Online Store or APIs are 2.9% plus $0.30

- Card on file transactions are 3.5% plus $0.15

- ACH bank transfers are 1% with a $1 minimum

Elavon Payment Gateway

Through Elavon, you can get their payment gateway, Converge. This gateway accepts debit cards, credit cards, ACH payments, mobile wallets, recurring payments, and gift cards. You can also take payments via their mobile app and add their buy button to your existing site. They also provide secure transactions and offer Fast Track Funding, which allows you to get your payment as soon as the next business day. They will give you a fixed rate for three years, and there are no extra charges or fees on top of that.

Magento Payment Gateway

Magento is offered through Adobe Commerce. It is a scalable offering and will grow as you grow, allowing you to manage multiple locations and transactions in various languages and currencies. It works with PayPal, Klarna, Amazon Pay, credit cards, debit cards, and more. To get pricing for Adobe Commerce, you have to contact their sales department.

WordPress Payment Gateway

If your site is hosted on WordPress, then there are several plugins you can use to install a payment gateway. What type you choose depends on your site. If your site is secure, then you can pick one that won’t redirect the customer to a third-party page to complete the transaction, which may help reduce abandoned shopping carts. However, if your site isn’t secure, then you’ll want that redirect option to protect yourself from any information being stolen. Some payment gateway plugins available for WordPress include:

- WooCommerce

- BigCommerce

- PayPal

- Stripe

Time to Get Paid

Running an eCommerce site takes time and requires a lot of working parts, and a payment gateway is a huge part of that. With so many options available, it can be an overwhelming step in the process. If you choose a payment processing provider that can set it all up for you, like BlueCart, then all you’ll need to do is sit back and let them take care of making sure you’re PCI compliant, your site is secure, and your customers experience a seamless payment process. You can even accept eCheck payment or recurring payments without having to worry about processing the data yourself.